Do you ever feel like your earnings aren’t enough? That there exists an imbalance between your income and inflation? You’re not alone. Inflation is a sneaky thief, silently eroding the value of your hard-earned cash. But what if I told you there’s a way to fight back? Enter: investing.

When it comes to financial freedom, investing isn’t just a buzzword—it’s your ultimate bestie. As of February 2024, the number of female investors in India stands at approximately 7.9 million, which is almost 28% of the total investor base. Forget damsels in distress – today’s Indian women are financial warriors! We’re ditching the backseat and grabbing the wheel when it comes to our financial futures.

The good news is you don’t need to be a financial expert to get started. But with so many investment options out there, it can feel a little overwhelming. Don’t worry, we’ve got you! Whether you’re in your 20s, 30s, or 50s, it’s never too early (or too late!) to start. This blog will serve as your guide and will break down the investing world in a way that’s easy to understand and fun to explore. So keep reading to unlock your financial potential!

Why Investing is Your BFF

Investing isn’t just about leading a fancy life and designer bags (although, hey, you do you!). It’s about building a safety net and ensuring your financial security. Here’s why investing is a must-have in every Indian woman’s toolkit:

Be Your Own Boss: Investing empowers you to build wealth, giving you the freedom and independence to make your own financial choices. According to the Women Investment Behaviour Report 2024, nearly 72% of women now make independent investment decisions, with younger generations leading this trend. No more relying on others – you’re in control!

Future You, Thank You: Life throws curveballs, and sometimes that means taking a break from your career. Investing ensures you have a financial cushion, so you can focus on what matters most without stressing about the bills.

Confidence is Key: Financial knowledge = empowerment. As you learn about investments, you gain the confidence to make smart choices for your future. Women already hold 33% of mutual fund Assets Under Management (AuM) in India—a number that’s climbing fast.

But what to invest and when? Let’s get into that next.

Your 20s: Plant the Seeds of Wealth

I’m sure you must have heard this a lot, but your 20s are the perfect time to start investing and even maybe take some risks! In your 20’s your responsibilities are comparatively manageable and since you’ve got a long road ahead, you can afford to take risks and learn from them.

One of the biggest advantages of investing in your 20s is the power of compounding. Compounding is like your money earning money on itself. Not only do you earn money on your initial investment but also on the return accumulated over years.

The earlier you start investing, the longer your money has to benefit from compounding. This gives you a huge head start for achieving your long-term financial goals. Here’s where to start:

Mutual Funds:

Mutual funds are your go-to if you want professional fund managers to handle your investments. Whether you’re into equity funds (for long-term growth), debt funds (for stability), or hybrid funds (a mix of both), there’s something for every kind of investor. You can start small through SIPs or go big with a one-time lump sum investment.

SIPs (Systematic Investment Plans):

Think of SIPs as your investment starter pack. SIP is a way to invest money regularly, like saving a little bit every month. Even if it’s just ₹500 a month, it grows over time thanks to the magic of compounding. And guess what? The average SIP size among women investors is now ₹3,738 per month, showing how we’re nailing the habit of consistent saving.

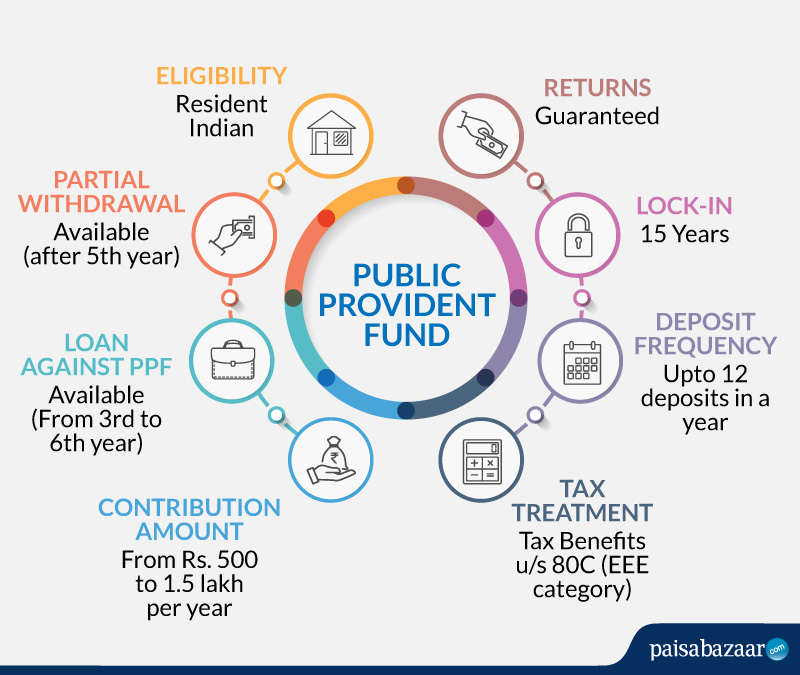

Public Provident Fund (PPF):

This government-backed scheme is the OG of long-term savings. With a 15-year lock-in period, it’s perfect for keeping your future self-covered while enjoying tax benefits and attractive interest rates.

Use apps like Groww or Zerodha to automate your SIPs and track your PPF contributions.

Your 30s: Chase Your Dreams, Secure Your Goals

Your 30s are all about leveling up. Whether it’s planning for a dream home or setting up a retirement fund, it’s time to diversify. This is the age to build up that investment portfolio.

Equity Linked Savings Scheme (ELSS):

Want to grow your wealth while saving taxes? ELSS is your go-to. These funds invest in stocks and come with a 3-year lock-in period. Historically, ELSS funds have provided returns in the range of 10-12%, making them suitable for long-term growth. Investments up to INR 1.5 lakh qualify for tax deductions, with gains over INR 1 lakh taxed at a rate of 10% as Long-Term Capital Gains (LTCG). Perfect for long-term goals like buying property or starting a business.

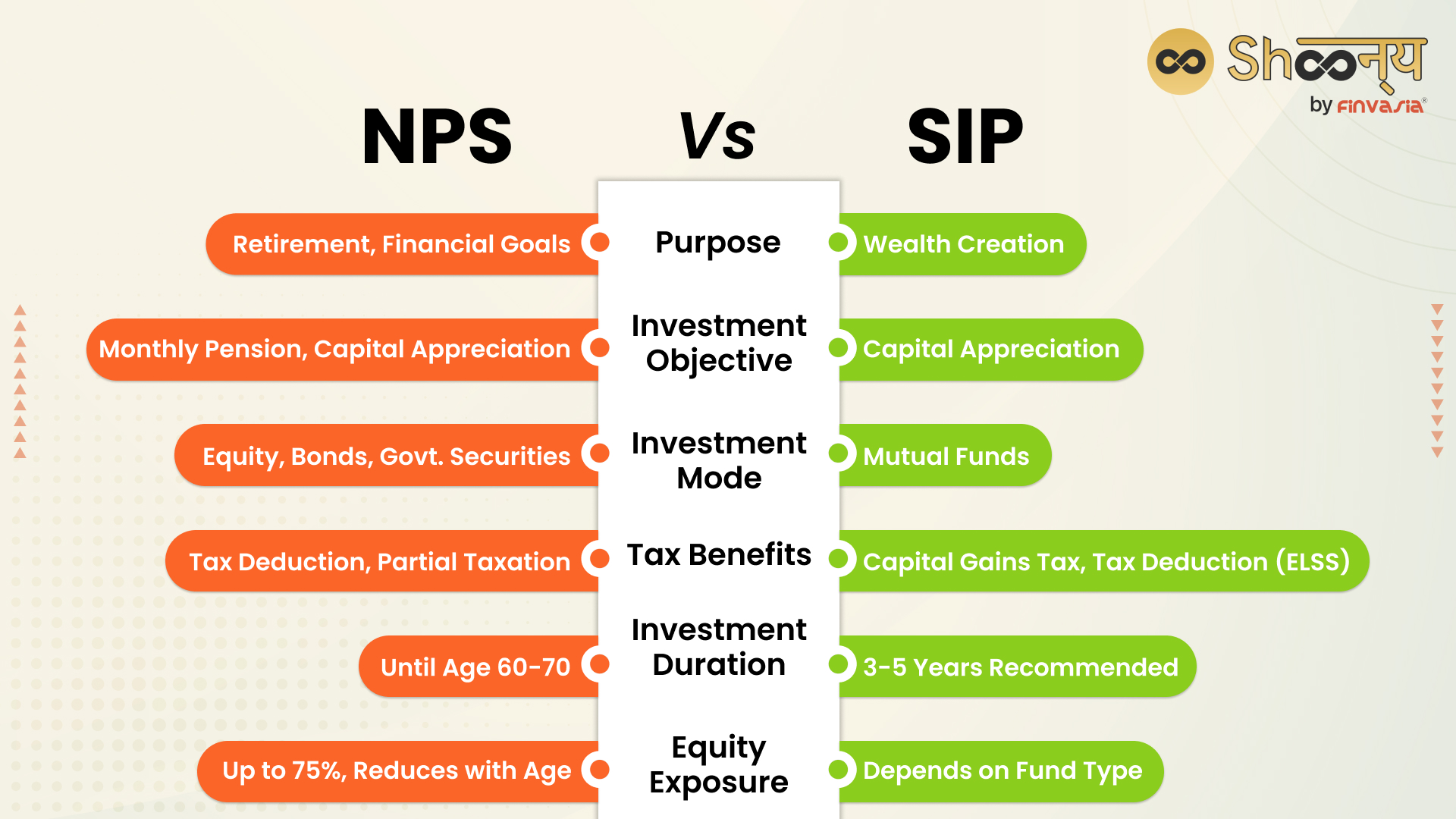

National Pension System (NPS):

Retirement planning may not sound exciting, but you’ll thank yourself later. Contributions are eligible for tax deductions under Section 80C, with an additional deduction of INR 50,000 available under Section 80CCD(1B). It is also flexible as it allows you to choose between different asset classes based on your risk appetite, allowing for personalized investment strategies.

Your 50s: Prioritize Stability

By the time you hit your 50s, it’s all about securing your future and protecting your loved ones.

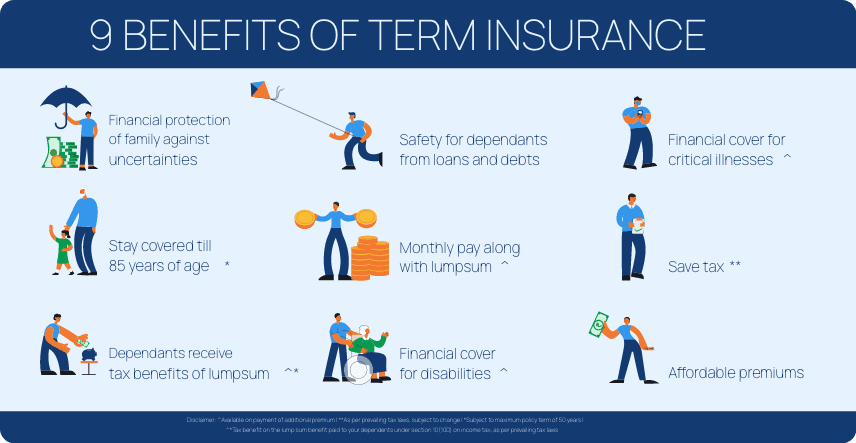

Term Insurance:

Think of term insurance as a shield for your family. These plans ensure that dependents are financially secure in case of the policyholder’s untimely demise.

Premiums paid are al eligible for tax deductions under Section 80C.

It’s affordable, and premiums for women are often lower thanks to our longer life expectancy. Win-win!

Use this decade to rebalance your portfolio—shift focus to safer investments like bonds or fixed deposits for steady returns.

Investing isn’t just about building wealth—it’s about building confidence, independence, and a future you’ll be proud of. Whether you’re setting up SIPs in your 20s, chasing big goals in your 30s, or securing stability in your 50s, there’s an investment option tailored for you.

The best time to start? Right now. Download an investment app, consult a financial advisor, or just set aside a small amount and watch it grow. Remember: the earlier you start, the more you’ll have to celebrate later.

Ladies, the financial world is waiting for you to take over. So, what are you waiting for?